2024-5-15 15:56 |

As Ethereum (ETH) grapples with a downward spiral in its market value, recent large-scale withdrawals from exchanges by whales have injected a dose of optimism into the cryptocurrency community. The past week has witnessed a flurry of significant transactions, indicating strategic maneuvers by institutional players to fortify their positions amidst market volatility.

According to insights from “The Data Nerd,” an analyst specializing in tracking unusual crypto transactions. Coinbase has recorded multiple high-value Ethereum withdrawals.

On Tuesday, the pundit reported that within 24 hours, four distinct wallets orchestrated withdrawals totaling a staggering 78,301 ETH, equivalent to approximately $231.2 million. Notable among these transactions were withdrawals by wallets labeled “0xF7f” and “0xE51,” each withdrawing 30,440 ETH, amounting to around $90 million.

This surge in withdrawal activity follows closely on the heels of a substantial transaction reported on Monday by the same analyst. A single whale, identified by the address “0x36D,” withdrew 23,286 ETH, valued at approximately $67.83 million, from Coinbase. Over four days, this entity executed withdrawals totaling 30,870 ETH, worth roughly $89.7 million. Such pronounced movements by influential market participants have ignited discussions regarding their potential impact on Ethereum’s price trajectory.

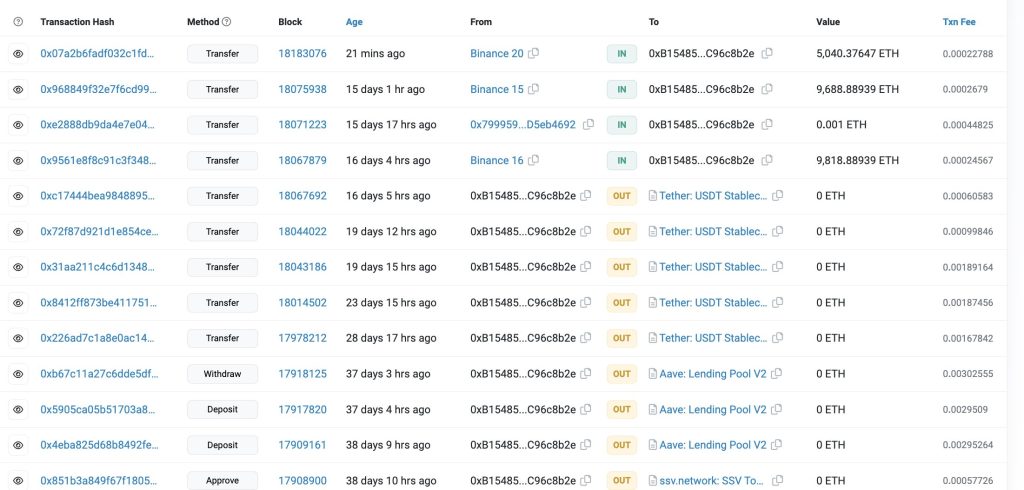

That said, the recent influx of withdrawal activity echoes earlier reports indicating whale investors’ significant accumulation of Ethereum. On May 9, crypto transactions tracking platform Lookonchain highlighted a whale who initiated a series of sizable acquisitions, culminating in the withdrawal of 6,030 ETH from Binance. This move, valued at over $18 million, was interpreted as a strategic maneuver to bolster holdings amidst anticipation of a market rebound. Subsequently, the investor staked the acquired Ethereum into Lido, a decentralized liquidity staking protocol, further underscoring confidence in Ethereum’s long-term prospects.

Analysts suggest that these maneuvers reflect a broader trend of large investors leveraging decentralized finance (DeFi) tools to enhance their positions in the cryptocurrency market, particularly Ethereum. By utilizing staked Ethereum as collateral to secure loans from decentralized lending protocols like AAVE, investors can access additional capital to fuel further acquisitions and capitalize on projected price surges.

Despite Ethereum’s recent price volatility, optimism persists within the market. At press time, Ethereum was trading at $2,916, representing a modest drop of 1.78% over the past 24 hours. Analysts are now eyeing $2,900 as a potential floor for the beleaguered asset, with resistance building around $3,310.

origin »Bitcoin price in Telegram @btc_price_every_hour

Market.space (MASP) на Currencies.ru

|

|