2020-9-18 06:00 |

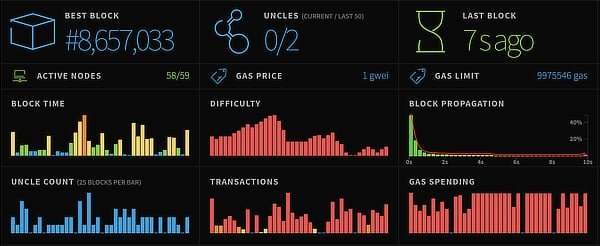

The Ethereum blockchain has become congested after multiple days of low activity. According to GasNow, an ETH transaction fee tracker, the average gas price users of the network are paying has spiked over 500 Gwei.

This means that it costs in excess of $50 to trade on Uniswap and it will cost much more if you want to complete more complex DeFi transactions.

Here’s what’s going on with Ethereum’s transaction fees and what this may mean for the rest of the crypto market.

Related Reading: This European Crypto Exchange Was Just Hacked for $5 Million Why Are Ethereum Transaction Fees Shooting Higher?Ethereum’s transaction fees are spiking due to the launch of Uniswap’s native coin, UNI.

The coin’s launch was predicated on making the coin community-owned. That meant that tens of thousands of users were required to make a handful of transactions — upward of three or more — just to claim, sell, or transact their coins from address to address.

Related Reading: Here’s Why This Crypto CEO Thinks BTC Soon Hits $15,000 Could Hurt the DeFi Bull MarketRyan Watkins of Messari fears that this high fee situation could be dangerous for the long-term growth in the space:

Ethereum is damn near unusable right now. I can only imagine what retail will think if they eventually come into this market and face $50+ gas fees and 10+ minutes transaction confirmations. This has been my biggest anxiety about this bull market. The protocols are ready, the infrastructure is not.

Ethereum is damn near unusable right now.

I can only imagine what retail will think if they eventually come into this market and face $50+ gas fees and 10+ minutes transaction confirmations.

— Ryan Watkins (@RyanWatkins_) September 17, 2020

This was echoed by many others in the space. Others note that the high Ethereum transaction fees are likely to put a “hard cap” on the ongoing bull market because at one point, a majority of retail users will get priced out, making this a whale’s market.

Related Reading: It’s “Logical” for Ethereum To Reject At Current Prices: Here’s Why Featured Image from Shutterstock Price tags: ethusd, ethbtc Charts from TradingView.com Ethereum Transaction Fees Surge to All-Time Highs—And That's Not Good origin »Bitcoin price in Telegram @btc_price_every_hour

Data Transaction Token (XD) на Currencies.ru

|

|