2021-11-7 04:00 |

As this bitcoin price bull cycle carries on, everyone wants predictions of when the price may top out. We will add one framework to the mix.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

As the bull cycle carries on, everyone wants price predictions and a better understanding of when the price may top out and reverse course. Although we expect bitcoin to reach a six-figure price this cycle, it’s difficult to estimate how far the cycle will extend beyond that. There’s a lot of different models, thoughts and projections on this already. We will add one framework to the mix using long-term holder cost basis and long-term holder historic spent output profit ratio (SOPR) trends. This shouldn’t be taken as a price prediction for the cycle but rather a logical thought exercise based on simple historical assumptions.

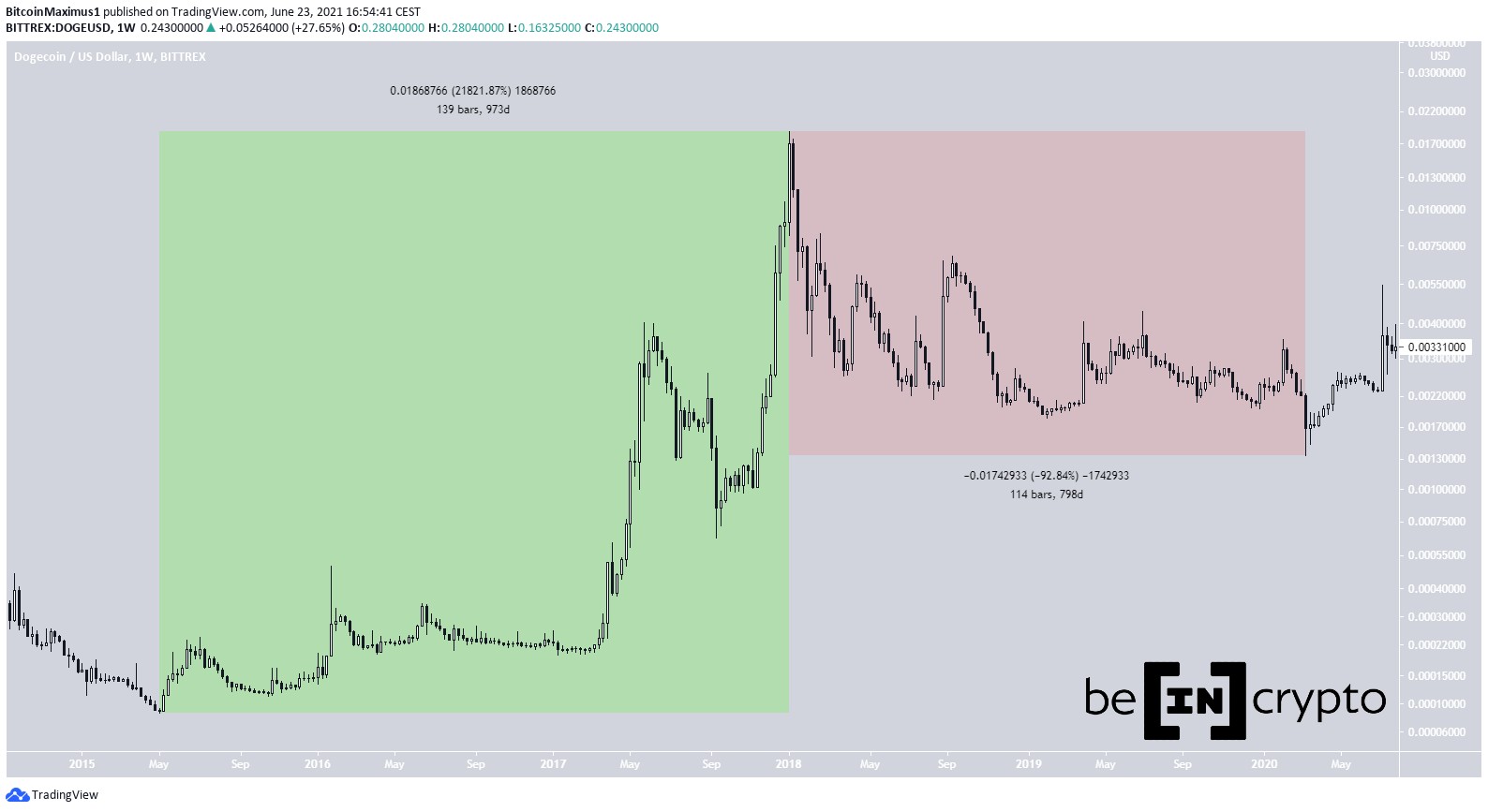

SOPR tells us price sold over price paid, indicating what profit levels long-term holders realized in the past. At the peak price over previous all-time highs in 2018 and 2021, long-term holder SOPR peaked at 20.74 and 9.04, respectively. Said otherwise, that’s 1,974% and 804% realized profit. A big market question is at what price level will a portion of long-term holders be incentivized to sell some of their bitcoin? That will likely mark the cycle top.

Source: GlassnodeUsing the long-term holder cost basis, an estimate for the market price paid, and the profit ratios of the past two cycles, estimates for price sold, we can multiply the two to get implied cycle top prices for this cycle.

For example, the long-term holder cost basis is now $17,751. If long-term holders look to take the same level of profits like they did at the previous all-time high (804%), the cycle price would need to be $160,469. If they expected to take profit levels at the peak in January 2018 (1,974%), the cycle price would need to be $368,157. A midpoint between the two would be 1,389% with a price around $264,000.

Source: GlassnodeIt’s also a fair assumption that long-term holders may expect lower profit percentage returns as larger returns diminish over time. So the long-term holder SOPR peak may exist below the January 2018 peak but above the previous all-time high, assuming that we haven’t reached the cycle top yet.

All that said, we don’t really know how this cycle will behave compared to previous cycles or how long-term holders will respond to profit taking this time around. Maybe they realize a lower level of profit this time around or hold out for higher prices, expecting a new type of adoption cycle unfolding.

After all, we’re not stacking sats to just get rid of them at cycle tops. This is a multi-decade adoption thesis where timing the local cycle tops won’t matter in the long-run.

origin »

Bitcoin price in Telegram @btc_price_every_hour

ETH/LINK Price Action Candlestick Set (LINKETHPA) на Currencies.ru

|

|