2023-8-14 16:00 |

On-chain data shows the trading volumes across the top cryptos have remained low recently, showing how disinterested the traders are.

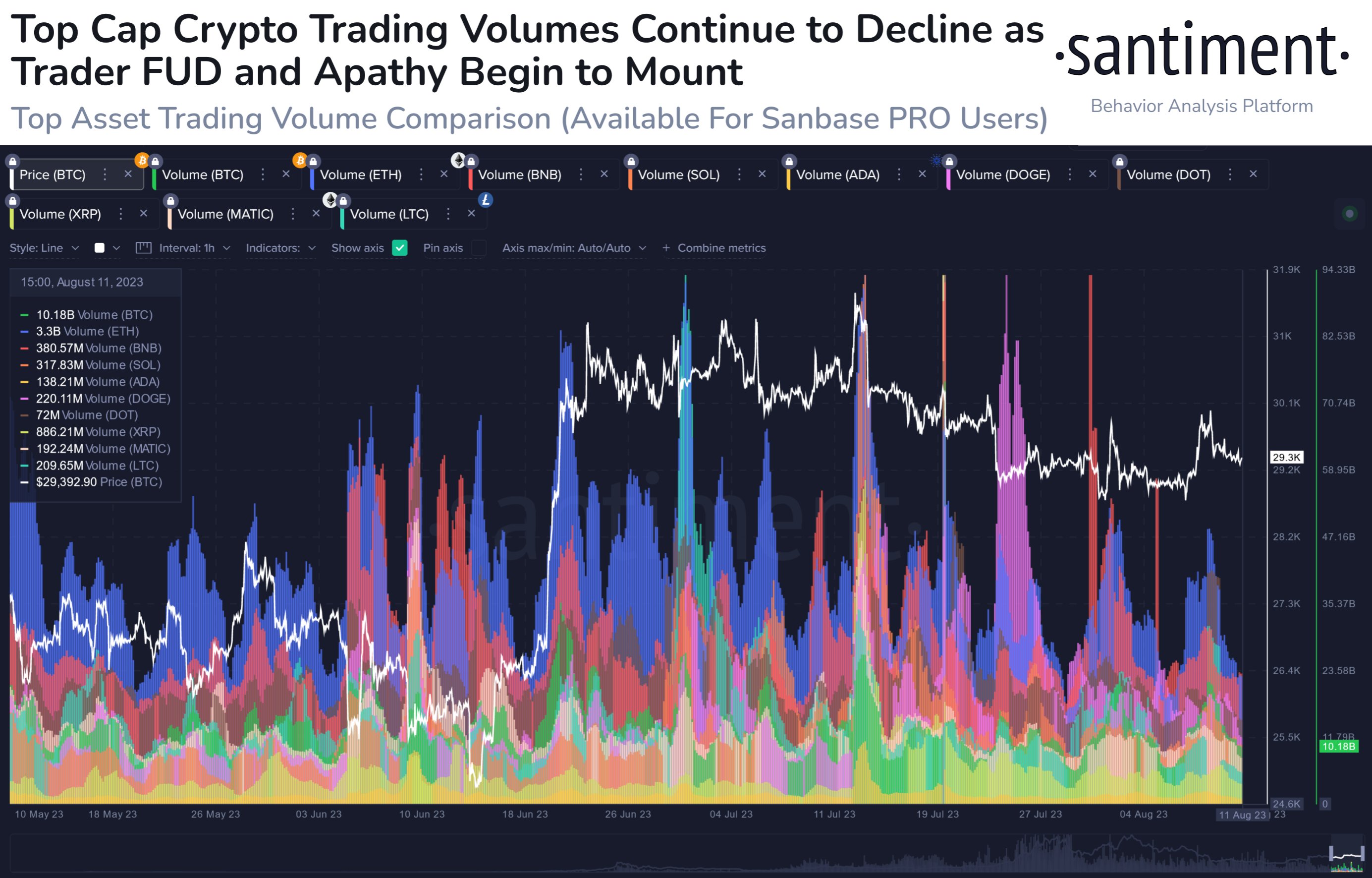

All The Top Assets In Crypto Sector Have Seen Lowering Volumes RecentlyAccording to data from the on-chain analytics firm Santiment, volumes in the crypto market have taken a hit recently. The “trading volume” here refers to a measure of the total amount of a given asset that the holders are moving on the blockchain right now.

When the value of this metric rises, it means that a large number of tokens of the crypto in question is seeing movement currently. Such a trend implies that traders are actively participating in the market right now.

On the other hand, low values can be a sign that the investors are disinterested in the coin at the moment, as the market isn’t observing much activity currently.

Now, here is a chart that shows the trend in the trading volume for some of the largest assets by market cap in the crypto sector:

As displayed in the above graph, the trading volume for these top cryptos has been in a general state of decline during the past week or so. This naturally means that activity related to these coins on their respective networks is dwindling.

This drawdown in the indicator has come for these coins as the market as a whole has been facing stagnation. Bitcoin, for example, has been stuck in the range between the $29,000 and $30,000 marks for quite a while now.

The volatility of the asset has been so low that its Bollinger bands have compressed to rare historical lows that have only been surpassed by the tight ranges of September 2016 and January 2023, as the lead on-chain analyst at Glassnode has pointed out in a recent post on X.

Amid this low volatility environment, it’s not all too surprising to see the trading volume going down. The reason behind it is that investors find such price action to be boring, so they stop paying attention to the market.

Like a self-fulfilling prophecy, these low volumes then in turn lead to more stale price action, as any moves that the crypto attempts to make fail before long as they run out of fuel.

Out of these top assets, only Solana has registered some positive volatility as it has gone up by 6% in the past week. SOL’s volume, though, hasn’t seen any significant improvement yet.

“As individual projects continue to have brief decouplings, watch to see when one may be associated with ascending trading volume to support it,” suggests Santiment.

BTC PriceAt the time of writing, Bitcoin is trading around $29,400, up 1% in the last week.

origin »Bitcoin price in Telegram @btc_price_every_hour

Emerald Crypto (EMD) на Currencies.ru

|

|