2023-4-27 15:34 |

Key Takeaways Bitcoin led markets on a ride Wednesday, surging from $28K to $30K before shedding 7% in an hour Surge had come following optimism for liquidity injection from Fed, as banking issues resurfaced at First Republic and shares cratered 50% Markets are too thin and prone to these large price swings, writes our Head of Research, Dan Ashmore Highlights how dangerous the sector can be in the short term, he says, warning enthusiasts to be careful

I wrote a few days ago about the state of crypto markets, warning that volatility was incoming following an unusually calm period for digital assets.

Last night that volatility came, and it came hard. It doesn’t make me a genius, as the timing was nothing more than blind luck, but it does demonstrate my point. The crypto markets are currently highly sensitive, even more so than usual, and that won’t change anytime soon.

On Wednesday morning, Bitcoin jumped from $28,300 to close to $30,000 in the space of a couple of hours. This came as First Republic Bank announced it had been subject to $100 billion of withdrawals last quarter, its share price tanking 50%.

Despite what enthusiasts may argue, crypto did not rise because the fiat world is collapsing, the banking sector going the way of the T-Rex and the dodo bird. Some decried crypto as a store of value outside of the creaking system, scooping up panicking investors fleeing the fiat world.

Sure, in the long term, there could be discussion to be had here, but that is for another day. Instead, it appears likely that coins surged in anticipation of more liquidity injections from the Federal Reserve.

In other words, crypto did what it has been doing all year: moved in response to expectations around the future path of monetary policy. A quick look at Bitcoin’s correlation with the Nasdaq shows this, now at a near-perfect 1 on a 90-day rolling basis, should affirm this. Bitcoin, and crypto as a whole, continues to trade like a highly risky tech stock.

But back to volatility. After the surge Wednesday morning, Bitcoin then plunged from $29,700 to $27,700, a 7% red candle in a little over an hour. As of Thursday morning, it is back at $29,000, as it reverberates all over the place, struggling to make up its mind.

Rumours swirled around the possible movement of Mt Gox coins, while some pointed to the apparent US government wallets becoming active. I had a quick look into these and it’s ultimately impossible to prove the two developments are connected. They may be, but it’s not clear that this is what caused the sharp fall.

In reality, this is exactly what I was pointing to earlier this week. Whatever the reason for the plunge, crypto markets are incredibly thin right now and primed for violent moves.

Capital has flooded out of the space over the last year at a remarkable pace. One nice way to illustrate this is by looking at the stablecoin balance on exchanges (deep dive here). Since December, over half the stablecoin balance on exchanges has evaporated, translating to $21.7 billion.

While the horrors of the FTX collapse may be banished to the back of investors’ minds, the effect on the crypto industry remains real. Alameda was a large market maker in the space, with that hole not filled since. Then there is the psychological impact; crypto’s reputation has taken a ferocious blow, with institutions scaling back perceptibly from the space.

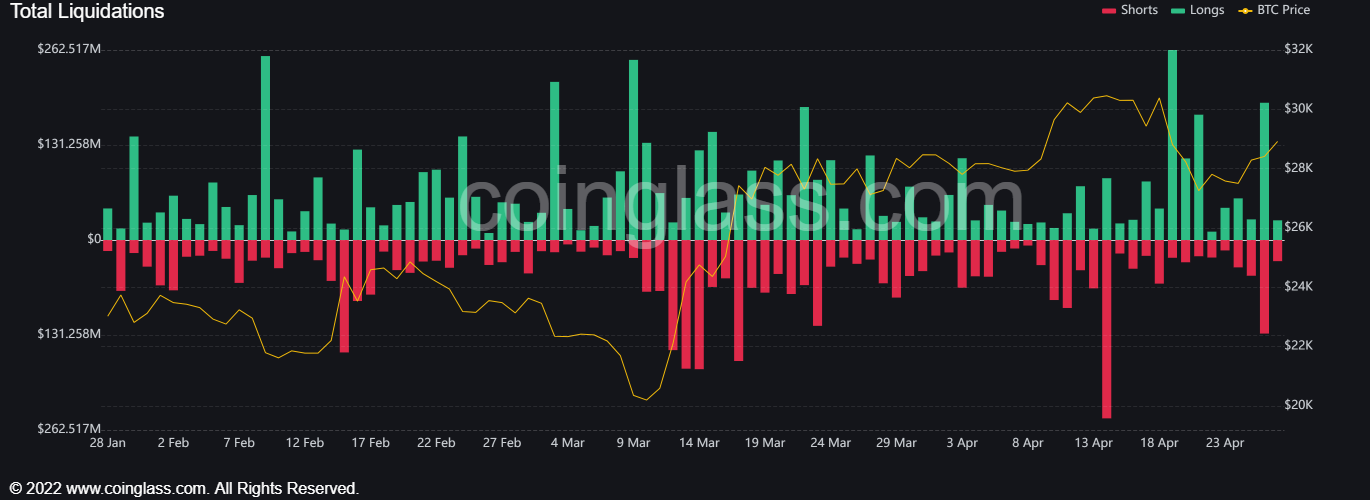

This has left liquidity low, and with low liquidity comes more volatility. Moves in either direction are amplified, which is what we saw yesterday. Looking at data from Coinglass, liquidations swelled for both longs and shorts, $180 million for the former and $130 million for the latter.

This volatility won’t go away anytime soon. Crypto was always more illiquid and prone to big moves than most mainstream asset classes, and this chasm has only widened in recent months.

It’s part of the reason why crypto remains so dangerous over a short-term time horizon. Get caught on the wrong side of one of these moves, and your investment can evaporate in an instant.

Oftentimes, there is no rhyme or reason, with the markets highly capricious. But with liquidity thin, it only needs a small spark and then liquations can cascade, sentiment can shift in the blink of an eye and prices can go wild.

Be careful.

The post Crypto has a wild day as $300 million liquidated: a story that won’t change soon appeared first on CoinJournal.

origin »Bitcoin price in Telegram @btc_price_every_hour

Wild Beast Block (WBB) на Currencies.ru

|

|