2020-12-18 10:20 |

Decentralized finance lending and borrowing platform Compound Finance is launching its own distributed ledger to enable the transfer of value and liquidity.

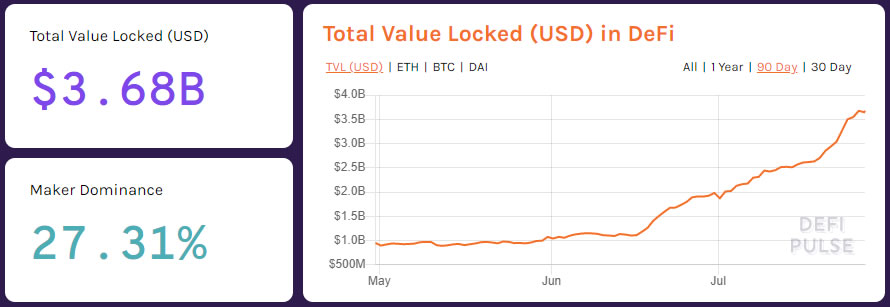

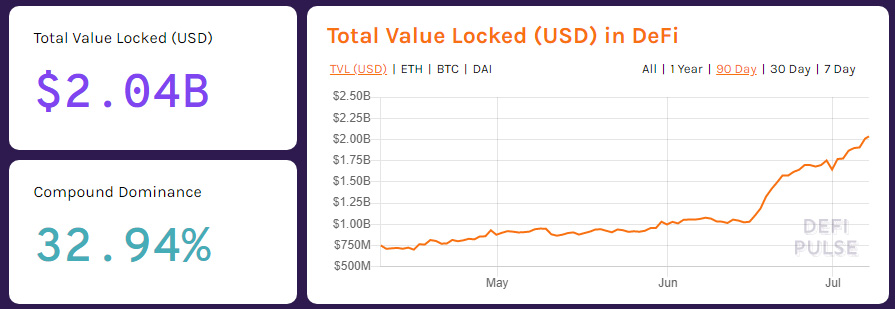

Compound Finance was the pioneer of liquidity farming, being one of the first to launch governance token distribution incentives in June 2020. The DeFi protocol is taking things a step further now with its latest product, Compound Chain.

The new blockchain has been described as being capable of inexpensively storing and transferring value and liquidity between peer ledgers, in other words, cross-chain interoperability.

Today, we're excited to share the whitepaper for Compound Chain, a distributed ledger capable of transferring value & liquidity between peer ledgers.https://t.co/TFjJ0JbToV pic.twitter.com/lCzrGyscPa

— Compound Labs (@compoundfinance) December 17, 2020 Another Ethereum Rival?One of the goals of the new ledger is to bring more assets to the Compound ecosystem, not necessarily compete with Ethereum;

“Compound Chain is a tool that could bring more assets into the protocol from a variety of ledgers e.g. Polkadot, Solana, Optimism PBC, Quorum, Celo, etc. It’s designed to complement the Ethereum contracts, be controlled by COMP governance, and extend DeFi network effects.”

CEO and founder Robert Leshner said this was a priority objective at a virtual DeFi summit in Bangkok, Thailand on Wednesday, Dec. 16;

“Over time more real world assets [will be added] as they become mainstream on the Ethereum blockchain.”

The whitepaper added that it will be a standalone blockchain preparing for the rapid adoption and growth of various tokenized assets from new ledgers including ETH 2.0 and central bank digital currencies (CBDCs).

Compound Chain will use a native unit of value called CASH which will standardized value across various disparate assets, and incentivize validation suggesting a proof-of-stake type consensus mechanism. The paper describes it as a proof-of-authority network operated by ‘governance approved validators.

CASH will be created by borrowing in a similar manner to the creation of DAI on MakerDAO and will be used to pay transaction fees. Lending, holding, and staking CASH can also accrue interest earnings.

The announcement added that the team is actively building a testnet implementation with a limited feature set, which it expects to be released next quarter (Q1 2021).

COMP Price UpdateCompound’s native COMP token, which kicked off the DeFi boom, climbed 13% yesterday with the broader crypto market. It is currently changing hands for $157, retreating from a daily open of $178.

COMP is trading up 7% this week but is up more than 40% so far in December as it recovers from a two-month lull. COMP is still down 36% from its peak of $245 in June.

The post Compound Finance Announces its New Multi-Asset Blockchain appeared first on BeInCrypto.

origin »Bitcoin price in Telegram @btc_price_every_hour

Wish Finance (WSH) на Currencies.ru

|

|