2021-7-22 20:00 |

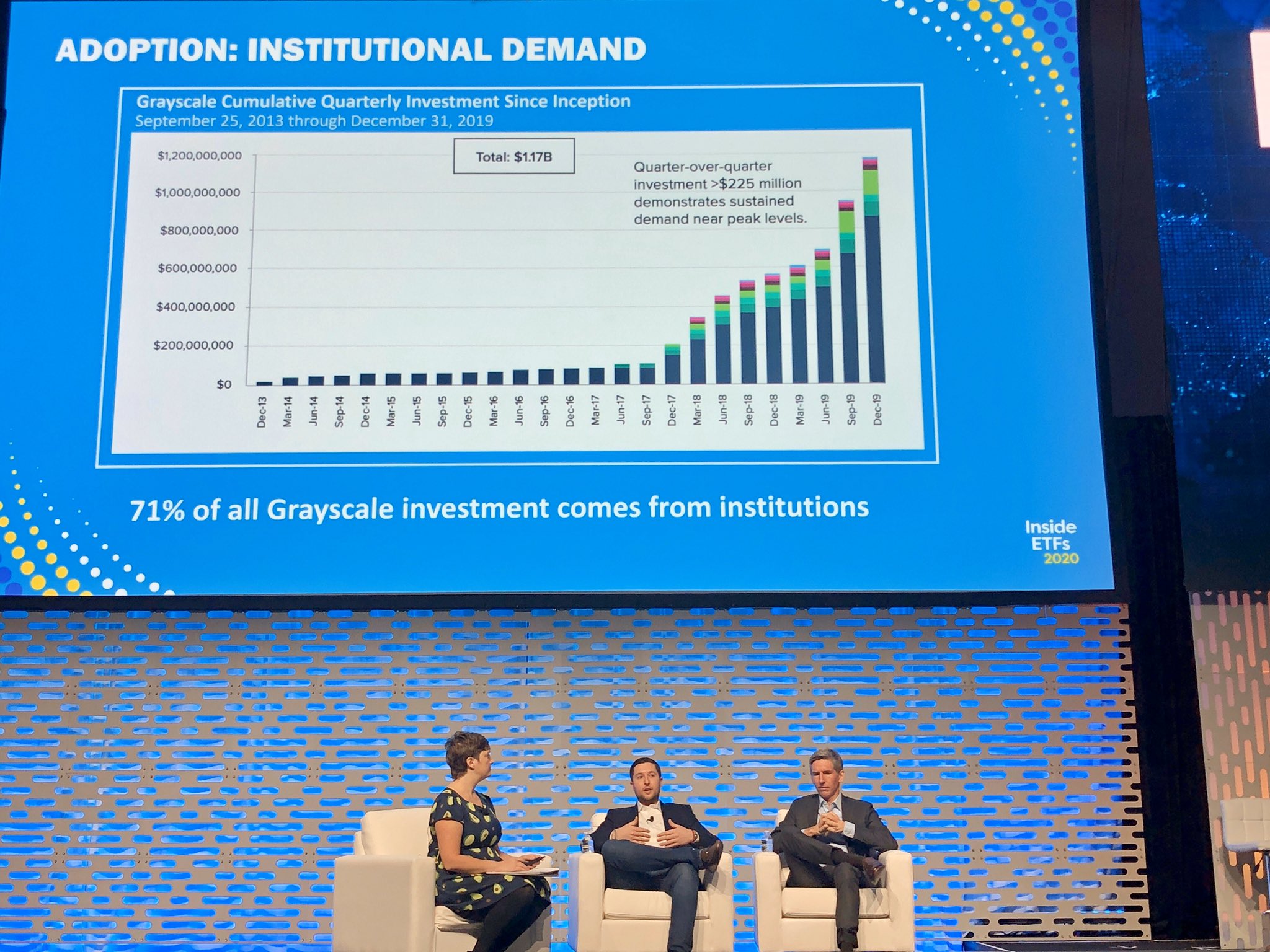

Ark Invest has now bought another $10.8 million worth of shares in Grayscale’s Bitcoin Trust. The investment firm bought another 2.14 million shares in the Grayscale Bitcoin Trust, bringing its total shares in the trust to a little over 7 million shares. The firm had been steadily increasing its stake in the Bitcoin trust which currently holds over 600,000 bitcoins, translating to roughly 3.1% of the crypto’s total supply.

Related Reading | Bitcoin Crashes Below $30,000, Bear Market Or Bullish Setup?

Bitcoin continues to struggle with recovery after the digital asset had plunged past $30,000 in July 2020. The digital asset has so far made a recovery past the $30,000 mark, but the price continues to show suffer from its all-time high in April. Despite this, institutions continue to show more faith in the market even as the price continues to suffer dips.

Ark Invest And CryptoArk Invest which has CEO Cathie Wood at the head has always been at the forefront of crypto investing. The investment firm was among the first to rush to invest in Coinbase when the cryptocurrency exchange had first gone public earlier in the year, listing on the Nasdaq.

BTC price posts recovery as price trades above $31,000 | Source: BTCUSD on TradingView.comBack in February, Cathie Wood revealed to Yahoo! Finance that she believed the digital asset could shoot up to as high as $400,000. Wood had stated that the crypto space would see more institutional investors coming into the market.

What surprised me and us generally was to watch MicroStrategy, which has put all the cash on its balance sheet into bitcoin — even did another equity offering so it could put more cash on its balance sheet. And I think that’s a little crazy because I think the regulators will have something to say about this. But then you saw Square put 1% of all of its assets in Bitcoin and I think you’re going to see more of that.

Cathie Wood had become popular in the investment world by making very risky calls and when those calls turned out to be right, like in the case of Tesla, the CEO’s notoriety increased tremendously.

Wood, who remains bullish on Tesla, continues to remain bullish on the digital asset.

Bitcoin Price MovementsBitcoin continues to see dips and recoveries as the price crash continues. The price of the digital asset had plummeted past $30,000 for the first time about a month ago, before making a sharp recovery to continue holding the $31,000 resistance point.

At the price crash below $30,000 a month ago, Ark Invest had purchased $29 million worth of shares in Grayscale’s Bitcoin Trust. Garnering over 1 million shares at the time.

Related Reading | Billionaire Tim Draper Is Unfazed By Market Downtrend, Doubles Down On $250,000 Bitcoin Price Target

The most recent purchase by Ark Invest took place on Monday and Tuesday when the coin had dipped below $30,000 for the second time in the span of a month.

This seems to put forward a pattern of purchasing for the investment firm. Every time the digital asset’s price dipped below $30,000, Ark Invest doubled down on its investment in the Grayscale Bitcoin Trust. Staying true to the belief of its CEO in bitcoin’s future.

Ark Invest also owns shares in crypto-adjacent Square and now has over $1B invested in Coinbase.

Featured image from SuperCryptoNews, chart from TradingView.com origin »Bitcoin price in Telegram @btc_price_every_hour

KuCoin Shares (KCS) на Currencies.ru

|

|