2024-2-14 20:30 |

On-chain data shows the stablecoin supply has surged alongside Bitcoin’s latest break above $50,000, a sign that could be bullish for the market.

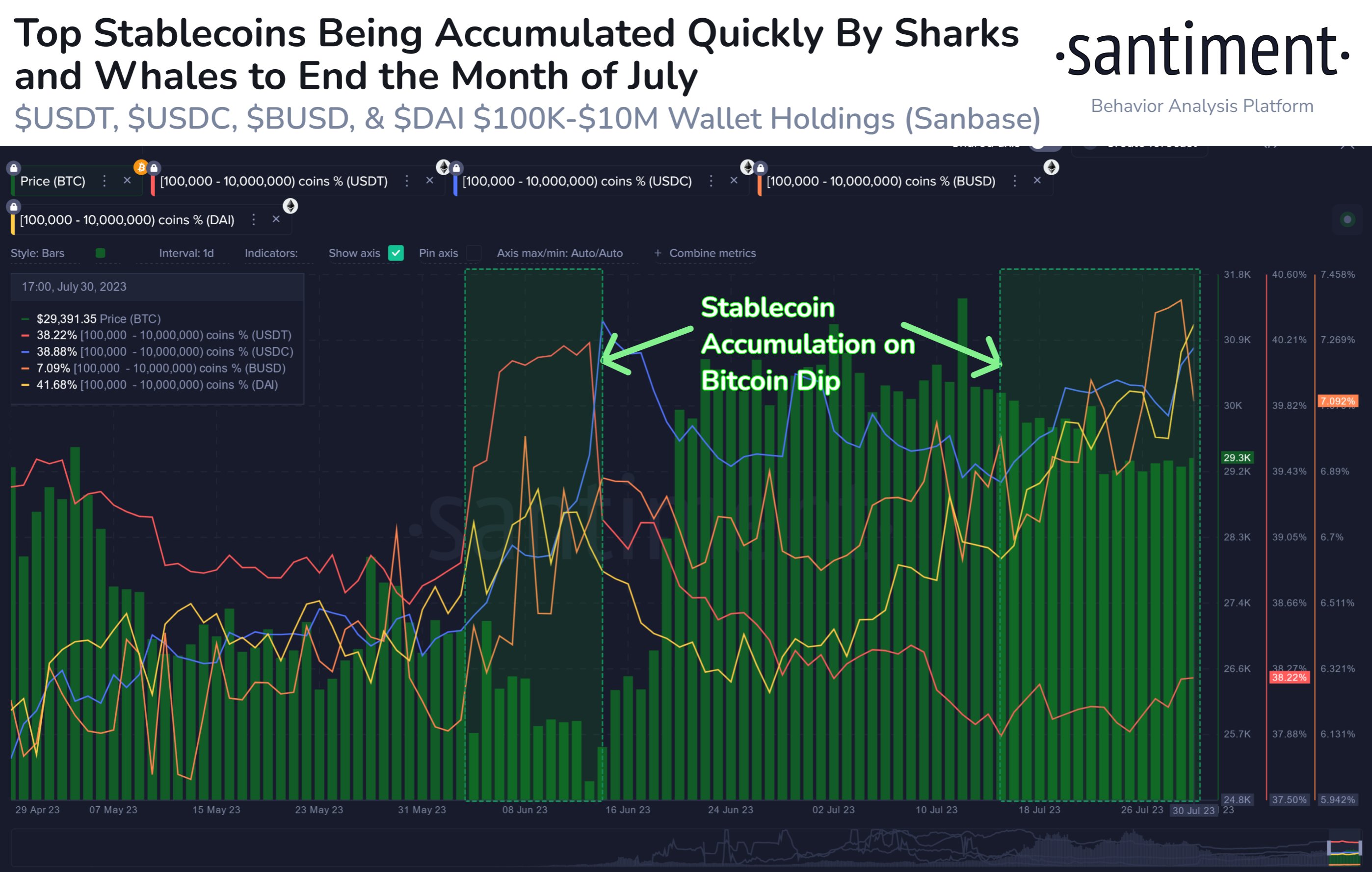

Both Bitcoin And Stablecoin Market Caps Have SurgedAccording to data from the on-chain analytics firm Santiment, the stablecoin market cap has recently grown. The “stablecoin market cap” here refers to the combined supply of the six largest stablecoins in the cryptocurrency sector.

Note that as these stables are all tied to the USD (meaning that their value remains around the $1 mark), the market cap and supply are interchangeable in their context, as they would be equal (unlike, say, in the case of Bitcoin, where they denote different things due to a fluctuating USD value).

The chart below shows the stablecoin market cap trend over the last few months.

The graph shows that the supply of stablecoins has been rising for a while now, suggesting that demand has been driving the issuance of more of these fiat-tied tokens. Since the start of the year, the market cap of the stables has surged by almost 5%, which is a pretty significant value.

The analytics firm also included data in the same chart for the percentage of the stablecoin cap held by investors with at least $5 million in their wallets.

It would appear that this metric has also seen a sharp increase in the last few weeks, as these whales have added 2.32% of the supply of the six largest stables to their addresses.

Now, what do these trends in these stablecoin indicators mean for Bitcoin and the wider sector? Their significance lies in why the investors would choose to invest in stables.

Traders generally use these fiat-tied tokens to escape the volatility of coins like BTC. However, such investors only plan to exit temporarily; if they wanted to leave the cryptocurrency sector as a whole, they might have gone for fiat instead.

When holders like these move into stables, the prices of Bitcoin and others naturally observe a bearish effect. However, once these investors exchange back into these assets, the prices feel a buying pressure instead.

The stablecoin supply can be considered the available store of dry powder for Bitcoin and others. Shifts from these coins into the stables aren’t the only way this dry powder grows; however, fresh capital inflows directly into the stablecoins also raise their market caps.

These fresh inflows are entirely bullish for the sector, as they aren’t made at the expense of the other coins. Recently, the stablecoin supply has grown, but at the same time, the Bitcoin price has also blown up.

Given this simultaneous increase, it would appear that a net amount of fresh capital has entered into both asset types in this rally as if it were just a rotation taking place; one of the two might have gone the opposite way.

This combination is naturally the most bullish possible for the sector, as it means that not only has the Bitcoin market cap gone up, but a dry powder that may potentially be deployed in the form of stablecoins has also risen at the same time.

BTC PriceAt the time of writing, Bitcoin is trading just under $50,000, surging by more than 16% in the past week.

origin »Bitcoin price in Telegram @btc_price_every_hour

USDx stablecoin (USDX) íà Currencies.ru

|

|