2023-6-12 14:42 |

On-chain data shows that Bitcoin miners may have been selling at a historical rate recently, something that could be bearish for the asset’s price.

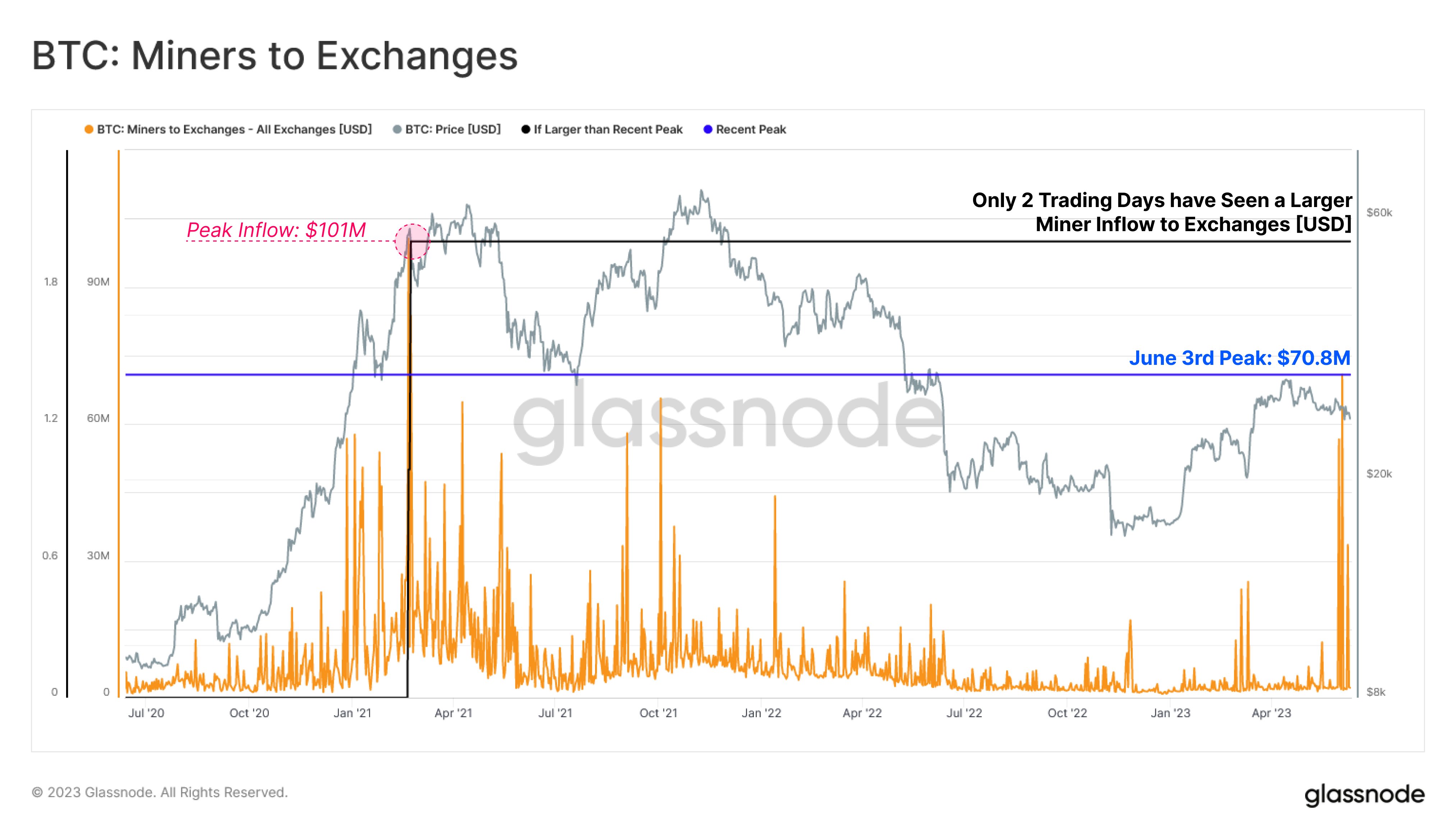

Bitcoin Miner Inflow To Exchanges Has Registered A Spike RecentlyAccording to data from the on-chain analytics firm Glassnode, miner exchange inflows hit a peak value of $70 million recently. The “miner inflow to exchanges” is an indicator that measures the total amount of Bitcoin that miners are transferring to the wallets of all centralized exchanges.

When the value of this metric is high, it means the miners are sending a large number of coins to these platforms currently. Generally, these chain validators deposit their BTC to exchanges for selling-related purposes, so this kind of trend can have a bearish effect on the value of the cryptocurrency.

On the other hand, low values suggest the selling pressure coming from the miners may be low right now, as this cohort isn’t depositing any significant amounts to exchanges at the moment.

Now, here is a chart that shows the trend in the Bitcoin miner inflow to exchanges over the last few years:

As displayed in the above graph, the Bitcoin miner inflow to exchanges has observed a spike in its value recently. This suggests that miners have been sending rather large amounts to these platforms during the past couple of weeks.

These high values of the indicator have come as the cryptocurrency has been gradually heading downwards. This may imply that the recent market environment has made some of the miners panic sell their holdings.

Since these inflows have become elevated, the asset’s value has only extended its decline further, as it has now dropped below the $26,000 level. This recent decline in the price may be fueled in part by the dumping being done by this cohort.

From the chart, it’s visible that the peak of these inflows observed on 3rd June saw the indicator reach a value of around $70.8 million. This is a historically extraordinary level for the metric as only two trading days in the entire lifetime of the coin have seen the miners depositing at a larger scale.

Both of the instances where miners sent larger amounts to these platforms took place way back during early 2021, when the bull market was in full flow. The peak inflow spike back then (that is, the largest value the metric has ever recorded) measured to about $101 million, implying that the current surge is about $30.2 million away from it.

Naturally, Bitcoin miners selling at such a high rate recently can be bad news for the market. It now remains to be seen whether these chain validators continue to sell more in the near future, or if they are done with their dumping spree for now.

BTC PriceAt the time of writing, Bitcoin is trading around $25,900, down 3% in the last week.

origin »Bitcoin price in Telegram @btc_price_every_hour

Bitcoin (BTC) на Currencies.ru

|

|