2023-5-26 13:09 |

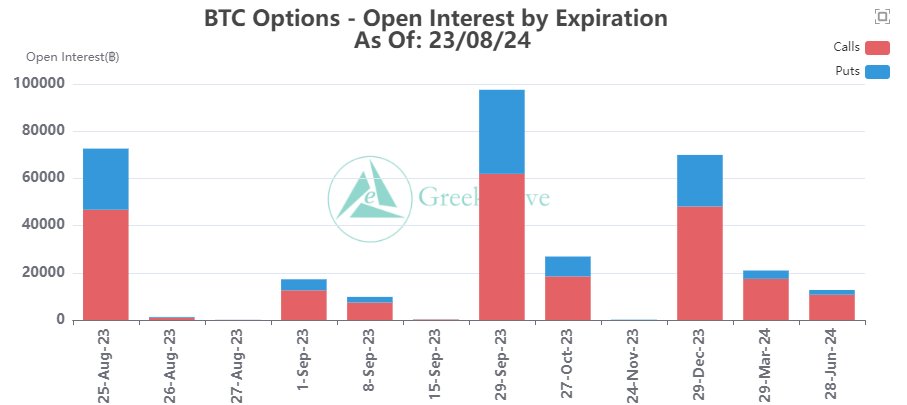

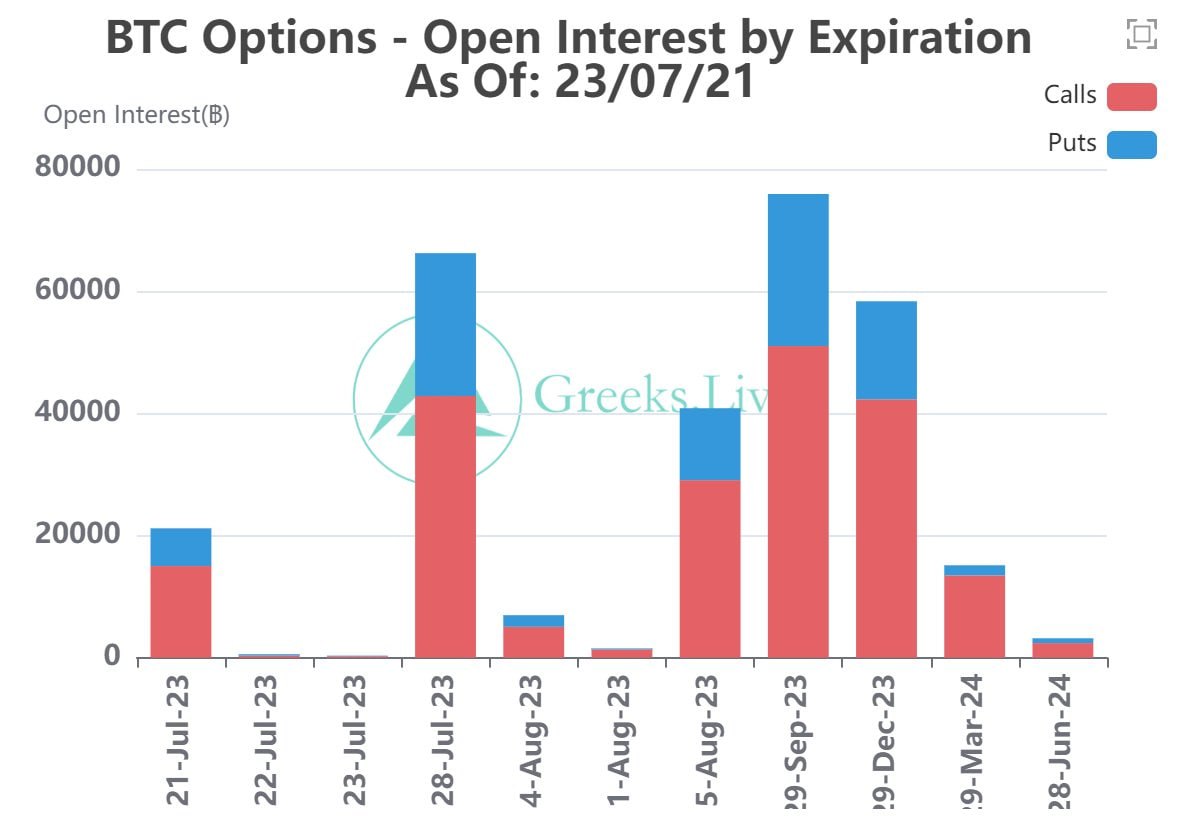

Quick Take Bitcoin and Ethereum held firm on a massive options expiry on May 26, according to Deribit data. Over $2.2 billion worth of options expired on May 26 for Bitcoin. Despite this significant event, the currency held firm above $26,300. The Bitcoin put-to-call ratio was 0.38, with max pain at $27,000. While the options on Ethereum saw an options expiry of a notional value of $1.3 billion. Ethereum had a put-to-call ratio of 0.49, with a max pain price of $1,800. Looking ahead to June, we anticipate a notional value of over $3B in options expiry, with a max pain price of $24,000. This notional value is slightly higher than the May expiration June Expiration: (Source: Deribit)

The post Bitcoin, altcoins stand tall despite options expiry pressure appeared first on CryptoSlate.

Similar to Notcoin - Blum - Airdrops In 2024

Bitcoin (BTC) на Currencies.ru

|

|