2019-3-6 13:22 |

Binance CEO Changpeng Zhao reaffirmed his commitment to users yesterday by discussing the recent delisting of crypto assets from the platform.

This took place via a live stream AMA on Twitter yesterday at 21:00 EST. In it, he covered a variety of Binance related news, including help for new projects via Launchpad, and challenges facing Binance this year. But from a broader investor perspective, his comments on failing projects brought to light a continuation of bearish sentiment.

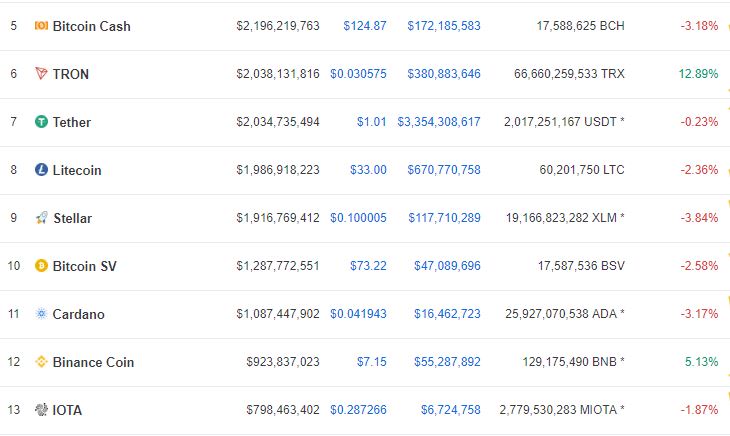

1-Year Valuation of the Crypto Market (Source: Coinmarketcap.com)

Maintaining Crypto StandardsBinance maintains a rigorous standard of policies to protect investors. And in the event of falling standards, the exchange has no choice but to delist a project. These standards are presented in their recent statement announcing the delisting of CLOAK, MOD, SALT, SUB, and WINGS.

Zhao expands upon these points by talking about the importance of having a large user base and providing utility value. But most emphatically, with regards to delisting factors, he draws attention to poor communication, and lack of response to status inquiry updates. Clarifying this stance, the Binance CEO objectively stated:

“When we list a project, we go for a certain number of criteria, and over time some projects might fall below that standard, and when they do we have to delist.”

And while Zhao acknowledges the detrimental effects of delisting, he continues to maintain a position of upholding the greater good:

“By delisting coins we realize that we hurt ourselves [and our users that hold that coin]. But the projects have to defend themselves, and most will go on with or without us.”

The latter part of 2018 saw a multitude of delistings from exchanges including Binance, OKEx, Huobi, and Kucoin. This recent cull is further evidence of a continuing decline in standards across the entire industry.

https://t.co/3FlqIp585L

— Binance (@binance) March 5, 2019

The Ongoing Bear MarketIt’s clear that many cryptocurrencies will not survive the bear market. Exchange delistings will happen during tough times, but it’s still shocking to hear of significant projects struggling – which is symptomatic of deeper set issues throughout the market.

In Substratum’s case, their announcement to day trade ICO funds to maintain capital was a significant blow. In his rebuttal to the delisting, Substratum CEO Justin Tabb was quick to deny any wrongdoing. However, this proved to be too little too late. Furthermore, with increasing regulatory pressure to legitimize the space, it’s inevitable that struggling projects will continue to fall out of favor.

Binance Delisting Factors Explained https://t.co/szGttvudel #substratum $sub #cryptocurrency #bitcoin #blockchain #technology #decentralized

— Substratum (@SubstratumNet) February 21, 2019

As one of the largest exchanges, Binance must maintain quality standards and a high level of integrity. Part of that is reducing the risk to investors by delisting projects that no longer meet those standards. While this is painful in the short-term, it is an excellent example of how the crypto-space is maturing.

Exchanges have a responsibility to maintain standards. And by concentrating on listing and maintaining only high-caliber projects, a sustainable future is more likely.

The post Binance to Continue Delisting Subpar Crypto Assets: Brutality of the 15-Month Bear Market appeared first on NewsBTC.

origin »Bitcoin price in Telegram @btc_price_every_hour

Binance Coin (BNB) íà Currencies.ru

|

|