2019-10-18 12:50 |

Binance has just upped the ante as the futures trading platform raises the bar with a new 125X leverage option on Bitcoin futures contracts.

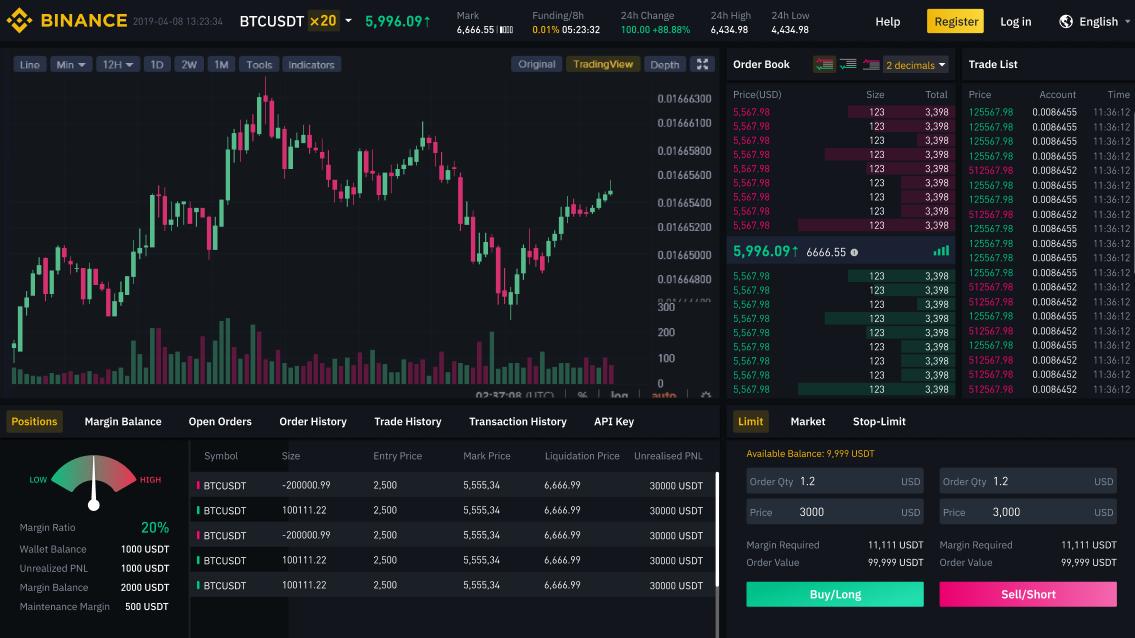

If you seek to profit from falling Bitcoin prices, or you simply find the current levels of volatility to not be stimulating enough, the Binance futures trading platform is available for short or long contracts that are bigger — and riskier — than ever offered before.

The exchange will support BTC/USDT contracts at the newly maximized margin, beginning today. Traders can select any leverage bet from as low as 2X all the way up to the new 125X. The company explains that at 125X leverage, a $100 USDT collateral deposit on Binance Futures will allow users to hold 12,500 USDT in BTC.

In comparison to competing futures platforms, Binance stands at the top of the high-risk pile, with competitors like BitMEX, Bybit, and Deribit maxing out at 100X leverage, according to bitcointradingsites.net.

Changpeng Zhao, CEO of Binance explains that the company has seen increased participation from institutional traders, who “seek out the most efficient ways to trade very quickly, both in terms of cost and performance.” He touts the platform’s smooth trading performance, explaining, “The market has been demanding a product with superior stability and performance; now we provide one.”

The company argues that the BTC futures contract provides a “sophisticated hedging tool that helps manage risk exposure.” To protect against auto-deleveraging, Binance uses a “leading risk management system,” while an “Insurance Fund” mitigates potential socialized losses.

Director of Binance Futures, Aaron Gong, said volatile game traders play to take advantage of fluctuations in the market, moving quickly between spot and futures trading, depending on the market conditions. With a predominantly retail-focused userbase, he explained that the company has seen an increase in traders “transferring in and out from spot to futures during volatile periods.”

The simplified process of moving funds between spot and futures on the integrated platform has boosted trading volumes. Gong said: “We’ve seen continued improvement in our volumes and market share, and we expect to see further gains in the coming months.”

There’s more to come in Q4, Gong emphasizes. Binance will offer several new features in response to community feedback, “as well as several surprises of our own.”

Leveraged futures trading is not for the faint of heart, nor for those on any sort of tight budget. While gains can be multiplied in leveraged trades, losses can be equally amplified, resulting in significant losses during periods of volatility.

The post Binance Futures Maxes Leverage Bar Out To 125X appeared first on Crypto Briefing.

origin »Bitcoin price in Telegram @btc_price_every_hour

Filecoin [Futures] (FIL) на Currencies.ru

|

|