2021-5-12 18:56 |

One of the biggest lending protocols in the decentralized finance (DeFi) sector, Aave, is now testing out some products for institutional investors.

This information was shared by none other than CEO and founder of Aave, Stani Kulechov, as he said, “It's a private pool for institutions that are still practicing before aping into DeFi.”

This tidbit was revealed by him when one user took to Twitter to share a message saying “AML warning” that the protocol sent to him.

“Your address has been blacklisted due to anti-money laundering regulation. You cannot interact with the dove Protocol from this address,” reads the message.

In response, Kulechov said that message was incorrect and not meant for him. That was when he gave away the alpha that Aave is all set to welcome the institutions that are desperately looking for yield in the current environment of near-zero interest rates. For them, the DeFi space that offers APY between 2-4 digits is simply mind-boggling.

“You can always use Aave Protocol – the protocol is decentralized, running autonomously on Ethereum network. The text is actually incorrect and relates to another pool we're testing out.”

The market, for obvious reasons, is simply euphoric, as the entry of institutions and their big bags can easily send the $100 billion DeFi sector to the trillion-dollar mark. But of course, that will come with certain rules and regulations.

“AML blacklisting is being implemented. Welcome to the age of defi regulation,” commented Ceterispar1bus on the latest development.

The price of Aave has already been enjoying an uptrend of 30% in the past 24 hours to trade at $570, ready to hit the all-time high of $575.15 from early February, propelled by YFI price going vertical and to almost six figures.

YFI 0.79%

yearn.finance / USD

YFIUSD

$ 75,830.87

$599.06

0.79%

Volume 2.79 b

Change $599.06

Open $75,830.87

Circulating 36.63 K

Market Cap 2.78 b

baseUrl = "https://widgets.cryptocompare.com/";

var scripts = document.getElementsByTagName("script");

var embedder = scripts[scripts.length - 1];

var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}};

(function () {

var appName = encodeURIComponent(window.location.hostname);

if (appName == "") {

appName = "local";

}

var s = document.createElement("script");

s.type = "text/javascript";

s.async = true;

var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=YFI&tsym=USD';

s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName;

embedder.parentNode.appendChild(s);

})();

1 h

Aave Is Testing Private Pools for Institutions to Ape into DeFi, Reveals CEO Stani Kulechov

4 h

Yearn Capitalizes on Retail Mania, Sends YFI to Nearly A Six-Figure ATH

1 d

Tech Stocks Dragging Bitcoin, Ether, & Crypto's Down, But 'Fundamentals Still Strong'

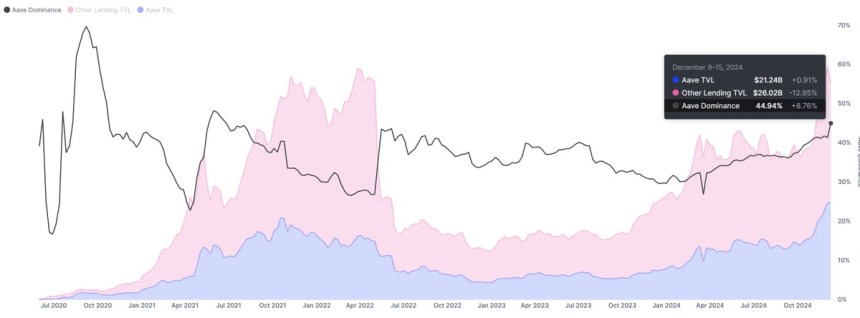

AAVE is currently a $7.2 billion market cap coin of the Aave protocol, which has been earning more than $3 million every day, starting this month, up from $200k per day at the beginning of this year.

The monthly revenue of Aave has surged from $6.38 million in January 2021 to $24.72 million in April and is already at $24.44 million, not even a fortnight-in in May.

The protocol also sits at 2nd spot with over $12 billion in total value locked (TVL), as per DeFi Pulse.

Aave/USD AAVEUSD 580.7470 $190.83 32.86% Volume 2.01 b Change $190.83 Open$580.7470 Circulating 12.74 m Market Cap 7.4 b baseUrl = "https://widgets.cryptocompare.com/"; var scripts = document.getElementsByTagName("script"); var embedder = scripts[scripts.length - 1]; var cccTheme = {"Chart": {"fillColor": "rgba(248,155,35,0.2)", "borderColor": "#F89B23"}}; (function () { var appName = encodeURIComponent(window.location.hostname); if (appName == "") { appName = "local"; } var s = document.createElement("script"); s.type = "text/javascript"; s.async = true; var theUrl = baseUrl + 'serve/v1/coin/chart?fsym=AAVE&tsym=USD'; s.src = theUrl + (theUrl.indexOf("?") >= 0 ? "&" : "?") + "app=" + appName; embedder.parentNode.appendChild(s); })(); var single_widget_subscription = single_widget_subscription || []; single_widget_subscription.push("5~CCCAGG~AAVE~USD"); The post Aave Is Testing Private Pools for Institutions to Ape into DeFi, Reveals CEO Stani Kulechov first appeared on BitcoinExchangeGuide. origin »Bitcoin price in Telegram @btc_price_every_hour

Aave (LEND) на Currencies.ru

|

|