2025-12-14 14:01 |

A dispute over revenue sharing has erupted between the community governing DeFi lender Aave and its primary development firm, Aave Labs.

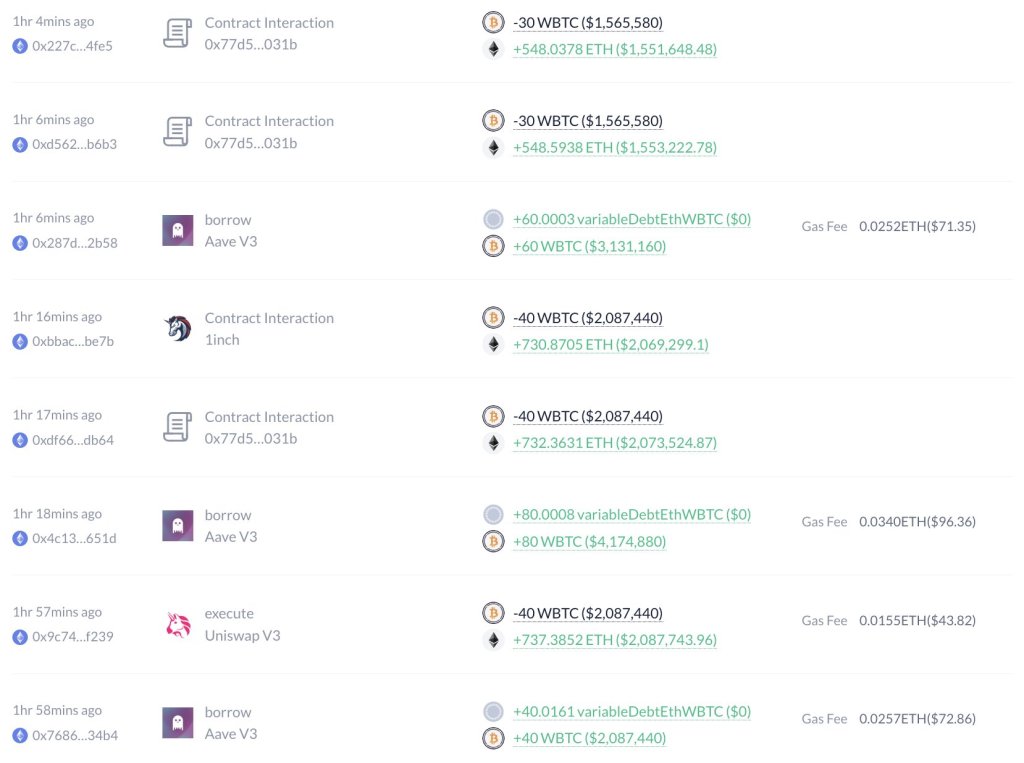

The conflict centers on Aave Labs’ recent decision to integrate CoW Swap as the underlying infrastructure for trading on the protocol’s primary website. The switch replaced ParaSwap, a previous integration that generated referral fees for the Aave DAO treasury.

DAO Members Question Economic Fallout From Interface UpdateGovernance delegates say the change has cut off a revenue stream of about $200,000 per week. On an annualized basis, they estimate the impact at roughly $10 million, shifting value away from token holders.

Marc Zeller, founder of the Aave Chan Initiative, criticized the move, calling it a “stealth privatization” of brand assets.

Extremely concerning.

The stealth privatization of approximately 10% of Aave DAO's potential revenue, leveraging brand and IPs paid for by the DAO, represents a clear attack on the best interests of the $AAVE Token holders.

We will prepare an official response with @AaveChan. https://t.co/opoG3I7x7s

Zeller argued that Aave Labs unilaterally altered the economic arrangement without seeking approval from the DAO, which governs the underlying smart contracts.

“Aave Labs, in the pursuit of their own monetization, redirected Aave user volume towards competition. This is unacceptable. By doing this integration, the Aave protocol lost two revenue streams that cannot be easily replaced,” he wrote.

Zeller warned that the lack of communication raises concerns about how future upgrades will be handled.

He pointed specifically to the upcoming V4 upgrade and questioned whether other “accessory features” could also be ring-fenced from the DAO.

“It is important to consider the picture as a whole to define if Aave Labs breached its expected fiduciary duty towards the Aave DAO and the AAVE token holders, and what we should expect from V4 in general,” Zeller concluded

Aave Labs Defend MovesIn a detailed response, Stani Kulechov, founder and CEO of Aave Labs, defended the integration, rejecting the characterization of the lost funds as stolen revenue.

Kulechov argued that the previous fees from ParaSwap were a “discretionary surplus” rather than a mandated protocol fee.

“It was never a fee switch, its been a surplus that we donated to the DAO,” he stated.

He also drew a sharp line between the Aave protocol, the DAO-governed decentralized smart contracts, and the front-end interface. He described the interface as a private product funded and maintained by Aave Labs.

Kulechov said Aave Labs bears the costs of engineering and security for the website. He added that the DAO does not subsidize ongoing product development expenses.

Consequently, the firm asserts the right to monetize the interface to ensure its sustainability.

“It’s also perfectly fine for Aave Labs to monetize its products, especially as they don’t touch the protocol itself,” he said.

The development firm also restated Kulechov’s position, acknowledging a failure to communicate the change effectively.

The firm said it switched to CoW Swap to deliver better execution prices and stronger protection against MEV (maximum extractable value), rather than to generate additional revenue.

The post Aave Governance Conflict Widens Over $10 Million Revenue Dispute appeared first on BeInCrypto.

origin »Aave (LEND) на Currencies.ru

|

|